Disclaimer: This opinion does not speak for any other real estate professional.

Introduction | Boykin v. Las Vegas Realtors et al

The real estate industry faces increasing scrutiny in the wake of the Boykin v. National Association of Realtors et al. lawsuit. However, serious concerns about the case exist, and much of the media coverage misrepresents how the real estate market functions in Las Vegas. A recent story published via the RJ is titled “The End Of The Evil Real Estate Empire.”

Las Vegas Real Estate Commission Lawsuit | Price-Fixing | The Fractions Fallacy

Consumers earn and save in whole dollars, not mere fractions. The plaintiff’s strategy, which accuses defendants of price-fixing and imposing excessively high fees, seems predicated on a deliberate attempt to mislead the jury. This misleading effort incorrectly suggests that the commission “percentage” is the primary economic factor in determining agent income.’ It neglects the crucial element of the average home value in each market. When combined with the commission percentage, this value determines the actual “commission” amount in dollars.

The variability of real estate commissions in Nevada illustrates the market’s influence on potential earnings for professionals. For instance, a 5% commission on the average home value of $356,000 in 2007 equated to $17,800. Following the market downturn, this figure dropped to $8,750 in 2012, with average home values at $175,000. By 2017, as the market recovered to an average value of $265,000, commissions rose to $13,250, still 26% lower than in 2007.

Even if we entertain the Plaintiffs’ flawed economic benchmark of percentages, a “4.5 to 6%” commission range results in a substantial 28% variance within this range.”

Las Vegas Realtor Commission Lawsuit | Claiming Transactions “Adversarial”

Real estate transactions are collaborative, as all parties seek the same goal. Studies or opinions cited by experts and real estate visionaries appear to agree.

For example, “Redfin Reports Nearly Half of Home Sellers are Making Concessions to Woo Buyers.” Also, David Eisenstadt of Berkeley Research Group and a former senior economist at the Justice Department’s Antitrust Division strongly advocate for the efficiency of sellers covering the buyer-broker commission at settlement.

Stephen Brobeck, A Senior Fellow At The Consumer Federation Of America | Real Estate Commission Decoupling Predictions

Mr. Brobeck’s first prediction stated, “Mortgage lenders and the GSEs (Fannie Mae and Freddie Mac) will quickly accept the desirability of buyer broker commissions being financed, then work with brokers to facilitate this transition. These lenders will understand that to afford a new home, many buyers will need these fees to be included in their mortgage. Lenders will also know that these fees are currently largely or wholly included in the sale price, so the size of loans will not change appreciably.”

Brobeck successfully resolves the contention surrounding three essential claims and settles the debate regarding two critical claims, effectively addressing all the significant points of dispute comprehensively.

- Shifting to a model where buyers directly pay commissions upfront rather than spreading the cost over a 30-year mortgage could significantly hinder the accessibility of homeownership. Brobeck appears to advocate for the current framework, warning that to “afford a new home, many buyers will need these fees to be included in their mortgage.”

- In a cooperative nature, Buyers share in the cost of commissions/fees as “these fees are currently largely or wholly included in the sale price.”

- Brobeck dismisses damages claims, citing that decoupling will result in the “size of loans will not change appreciably.” Buyers will lower the offer price to offset additional fees.

- “Consumers will remain focused on the sale and the sale price of the home or homes, not on commission levels.” And “they will depend on their real estate agent to help them sell or find a property at a desirable price.”

- “Discounters will increase market share, but this share will remain relatively small because most consumers want effective personal service from a single agent. While technology can routinize much paperwork, most buyers and sellers will still desire the assistance of a professional who can guide and reassure them.”

Material | Existential Risk For FHA & Veteran Home Buyers

The experts for the plaintiffs have irresponsibly hinged on a groundless prediction that FHA and VA would capitulate to a new commission paradigm, a prophecy unfoundedly broadcasted 1123 days ago. In a staggering display of negligence, the plaintiff’s legal team has utterly failed to procure or even present any formal endorsement from either FHA or VA to bolster such precarious conjectures. This blatant disregard and a profound lack of due diligence raise serious questions about the accountability and professional integrity of the counsel involved.

Las Vegas Real Estate Commission | Who Pays?

Mr. Broeck’s findings confirm that buyers and sellers contribute to transactional costs in real estate deals, as each party aims to meet specific net proceed targets. This mutual contribution underscores the shared interest in achieving favorable financial outcomes within the framework of property transactions.

Steering & Diminished Role Of Buyer Agent | Fallacy

Common claims state that the role of buyers’ agents has become obsolete due to technological advancements, “AS BUYERS OFTEN SELECT THE HOME THEY ACQUIRE BEFORE CONTACTING AN AGENT.”

Their claim falls apart when examining their simultaneous accusation of agents steering buyers toward or away from specific properties. This contradiction is glaringly irrational, undermining the premise that agents wield considerable influence over buyers presumed to have independently pre-selected their properties via online platforms.

Allegations of concealing properties are unfounded and ignore the reality that MLS syndicates properties to real estate portals.

THESE PLATFORMS ENSURE WIDESPREAD LISTING VISIBILITY ACROSS MAJOR REAL ESTATE WEBSITES SUCH AS ZILLOW, REALTOR.COM, AND REDFIN, COLLECTIVELY ATTRACTING OVER 109 MILLION MONTHLY VISITORS. SUCH WIDESPREAD ACCESSIBILITY TO LISTINGS, IRRESPECTIVE OF COMMISSION RATES, PROVIDES TRANSPARENCY THAT DIRECTLY REFUTES THE PLAINTIFFS’ BASELESS ACCUSATIONS.

As for claims of a buyer’s agent’s diminishing role, A study featured on Money.com titled “Want to Buy Your First Home? Get Ready to Tour 15 Houses and Make at Least 5 Offers” highlights findings of a study conducted by OpenDoor. The homebuying journey extends well beyond repeatedly browsing Zillow. Securing a worthwhile listing is just the initial step in a challenging process often filled with setbacks for first-time buyers. The following logistics involving viewing homes are taxing: the average first-time buyer inspects 15 properties, and a significant portion, 33%, view 20 or more.

Moreover, facing rejection is almost a certainty in this competitive market. Opendoor’s survey indicates that nearly all first-time homebuyers experienced losing out on a home they were interested in—98% to be precise, with the figure rising to 99% among millennials.

The Clear Cooperation Policy | Potential Legal Concerns for Non-Compliance Irrespective of NAR Affiliation

Plaintiffs imply that the CLEAR COOPERATION POLICY mandate for members to promptly list all properties on the MLS is underhanded. However, the omission of properties from the MLS could potentially breach legal standards.

Private listing services advocate for “Testing the Market” as a benefit. Nevertheless, this approach, adopted by sellers in concert with agents and private networks, amounts to a deceptive tactic at the buyers’ detriment. These parties engage in secretive price adjustments on private platforms, later introducing these properties on the MLS as new listings without any public record of price modifications or the actual duration on the market, thus distorting the true state of market conditions.

Such intentional concealment of essential information, particularly regarding price history and listing duration, severely undermines a buyer’s ability to make well-informed choices. This strategy, aimed at dodging market realities to boost property values artificially through dishonesty, is ethically questionable and verges on illegality. It potentially violates Section 5 of the FTC Act, which prohibits misleading practices in commerce and directly contravenes state laws such as NRS 645.252, requiring full disclosure of all relevant property information. By deliberately hiding crucial data like price adjustments and the length of market exposure, these entities neglect their ethical duties and blatantly breach the principles of transparency and fairness in market transactions. View Forbes Opinion.

NAR Rules | Stifling Competition Claims

Redfin’s recent 10k highlights the residential real estate market’s competitiveness: “Competition in each of our lines of business is intense.” Moreover, “Many of our competitors across each of our businesses have substantial competitive advantages, such as longer operating histories, stronger brand recognition, greater financial resources, more management, sales, marketing, and other resources, superior local referral networks, perceived local knowledge and expertise, and extensive relationships with participants in the residential real estate industry.”

Furthermore, OpenDoor promised to remove commissions altogether, allowing sellers to bypass agents and transact directly with the platform. However, the Federal Trade Commission (FTC) highlighted concerns with OpenDoor’s practices. Samuel Levine, Director of the FTC’s Bureau of Consumer Protection, criticized OpenDoor’s approach, stating, “OpenDoor aimed to transform the real estate industry but instead relied on misleading tactics about the potential financial benefits for homeowners using its service. Misleading consumers is hardly innovative.”

Compensation To Buyer Brokers Regardless Of The Buyer Broker’s Experience

Plaintiffs assert that the “defendants’ conspiracy forces home sellers to extend uniform compensation offers to buyer brokers without regard to the broker’s experience, services rendered, or financial agreements with the buyer.”

The seller is seeking a monetary outcome. Thus, commission obligations are performance-based, not tenure. If a buyer broker successfully introduces a buyer and completes a sale based on the price and terms set by the seller, this confirms that the buyer’s broker possessed adequate “experience.”

Limitations On Buyers’ Ability To Negotiate Commissions | Redfin Rebates

The discussion on whether buyers can negotiate real estate commissions has been highlighted by Redfin’s rebate program, which effectively allowed buyers to benefit in a way akin to commission negotiation by offering them rebates. This initiative demonstrated the possibility of adjusting traditional commission structures to favor consumers. However, Redfin discontinued the program and continues to face profitability challenges. On August 8th, 2022, Real Trends released an article entitled “Redfin Looks To Eliminate Agent Commission Refund,” which reported that the decision to revoke this policy led to receiving “few objections from customers or agents.”

INDUSTRY PARTICIPANTS | ADMONISHING 6% COMMISSION PERCENTAGES

Redfin CEO Glenn Kelman is often identified as the critic of 6% commissions within the industry narrative. However, Redfin’s practices and a 2022 legal settlement concerning allegations of redlining highlight contradictions in its stance. The company’s admission that economic considerations, rather than neighborhood demographics, guide its service offerings exposes a profit-driven approach that conflicts with its public denunciation of standard commission rates. This is particularly evident in how Redfin navigates markets like Joplin, Missouri, where it opts out of direct service due to economic feasibility, instead referring potential clients to partner agents, including Keller Williams agents, who surrender a sizable portion of their commission as referral fees.

Even while absorbing these referral fees, Keller Williams’ ability to operate in markets deemed unprofitable by Redfin points to a viable business model that contradicts Redfin’s purportedly altruistic criticisms.

Burnett v. NAR: A Verdict Likely to Crumble on Appeal | Burnett Fails To Set Any Legitimate Precedent | Deceptivly Flawed Economic Model Applied By Plaintiffs

Comparable Market Analysis: Economic experts agree that a thorough analysis of foreign markets should incorporate up to 36 considerations, with twelve being fundamental. In our assessment, Dr. Schulman did not adequately address any of these essential factors.

Plaintff’s economic expert, Dr. Schulman’s endeavor to pinpoint a foreign market that supports the narrative of Missouri agents imposing supra-competitive fees emerges as a profoundly flawed international search. Among 194 countries, Dr. Schulman failed to locate a comparable market; thus, in our view, Dr. Schulman introduced defective and misleading economic models while filtering out any data favorable to Realtors.

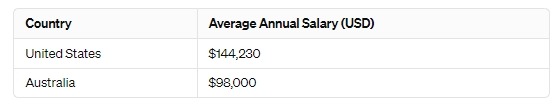

Essential to any analysis of average commission costs for sellers in varied global markets is the preliminary evaluation of average home values, alongside the critical consideration of currency exchange impacts. Dr. Schulman’s decision to compare commission costs in Australia v. Missouri was deliberately unacademic. With Australian homes averaging $760,221 (converted to USD), a standard 3% commission equates to $22,806. Coupled with the average capital gains tax of $52,000 in 2022 and a 4% stamp duty tax, adding another $30,408 for sellers buying another property. The total cost of buying and selling in Australia reaches an astonishing $105,214, far exceeding the US market.

At trial, under cross-examination, it was believed that Dr. Schulman admitted that he failed even to attempt to calculate the total commissions that any plaintiff paid, and his analysis was restricted to specifically named defendants in Missouri.

Real Estate Commission Lawsuit | Obligations Of Plaintiff’s Economic Expert Testimony

Economic experts testifying in court must adhere to several fundamental principles to ensure their contributions are credible and valuable:

-Accuracy: Provide reliable analysis based on established economic principles.

-Objectivity: Maintain impartiality, avoiding bias toward either party.

-Clarity: Present complex economic analyses clearly and understandably.

-Relevance: Ensure analyses are pertinent to the case’s issues.

-Confidentiality: Keep sensitive case information confidential.

-Professional Integrity: Adhere to ethical and legal standards.

-Disclosure: Reveal any potential conflicts of interest.

-Documentation: Offer detailed documentation for verification purposes.

We believe Dr. Schulman’s testimony resulted in a miscarriage of justice and financial loss, thus plausibly subjecting Dr. Schulman to civil liability for damages. Parties affected by the expert’s misconduct could potentially sue for compensation related to the harm caused.

Critical Overview Of Recent Settlements

Following the groundbreaking $5.35 billion Burnett verdict, the subsequent actions of the Plaintiffs’ counsel starkly reveal a deep-seated lack of confidence in their case. Settlements reached with Anywhere for $83.5 million and RE/MAX for approximately $55 million before the trial contrast sharply with the allegations made during the trial. The plaintiffs’ counsel dramatically portrayed Keller Williams and their CEO as central figures in an alleged price-fixing conspiracy. Nevertheless, paradoxically, after the multi-billion dollar verdict, they are now pursuing a settlement with KW for a sum notably less than that agreed with Anywhere.

The arithmetic of the settlements is telling; with an estimated 38 million class participants, the total settlement amount of $208 million—after deducting legal fees—dwindles to a mere $3.28 per class member from a hypothetical $124,800,000. Such a paltry sum per class member highlights the disproportionate benefit to the Plaintiffs’ counsel and the stark disparity between the claimed damages and the settlement figures.

Moreover, in the MLS PIN case, the Plaintiffs’ counsel negotiated a settlement that conspicuously favored their enrichment without allocating any financial compensation to the class participants themselves. This approach drew criticism from the Judge and The Justice Department, which intervened, criticizing the settlement as too lenient and failing to adequately address the alleged real estate commission malpractices.

The willingness of the Plaintiffs’ counsel to accept such relatively minor settlements, despite their public assertions of consumer harm running into billions, strongly suggests an acknowledgment of the fundamental weaknesses within their cases. It appears that, upon closer scrutiny, their claims might not withstand legal examination, hence the rush to secure settlements that, while enriching the attorneys, provide negligible benefits to those they claim to represent.

Legal Industry Fees | Shockingly Hypocritical

Despite technological advancements in the global legal landscape, US lawyers continue to stand out for imposing fees that are significantly higher than those charged by their counterparts in other G20 member countries.

IBM LEGALMATION’s studies showcase the stark benefits of integrating new technologies within the legal industry, promising:

1. Drastic reductions of up to 80% in time spent on critical litigation tasks.

2. Enhanced profit margins for high-volume cases.

3. More innovative marketing strategies.

4. Improved job satisfaction for associates.

Despite the efficiency gains offered by technology, there has been an aggressive push for rate hikes within the sector. On February 15th, 2023, an article titled “As Law Firms Push Aggressive Rate Increases, Clients Have Room to Negotiate” disclosed that some firms had imposed “shocking” rate increases at the higher spectrum, with about 15% of Am Law 100 firms boosting their fees by 10% to 20%.

Further compounding the issue, another article from November 13th, 2023, “By-the-Hour Billing Torments Legal Departments. So Why Aren’t More Demanding Alternatives?” exposes a rigid adherence to billable hours—a model that many in-house attorneys find too entrenched to challenge.

Consultant Ken Callander’s observations encapsulate this inertia: “Billable hours is all they know… Moving toward something other than that is really foreign to them.”

Consumers who are unable to afford hourly legal rates are often forced to engage contingency-based law firms, where fees can soar to as much as 40%. In the first nine months of 2023, the top 100 US law firms billed an average hourly rate of $961. In Missouri, Gibson’s Plaintiff’s counsel, Michael Ketchmark, projects himself as a defender of nurses and teachers. However, the financial disparity becomes stark with an average annual teacher’s salary in Missouri at $43,600. When comparing a teacher’s income to the hourly rates charged by premier law firms, consumers are cornered into a choice: forfeit up to 40% of a settlement in contingency fees or face hourly billing that could deplete a teacher’s yearly earnings in just 46 hours.

Contingency-based law firms that critique the fee structure of the real estate industry exhibit a remarkable lack of self-awareness, bordering on a pathological level of narcissism.

Our investigation uncovers substantial violations of legal and ethical norms, ranging from American Bar Association guidelines to state regulations. This includes conduct that might be construed as bribing a public official—a Class E felony. Consequently, we have forwarded our findings to the Executive Office for United States Attorneys, pertinent FBI Special Agents in Charge, and the Defense Intelligence Agency for further examination.

Conclusion

The Plaintiffs’ allegations and the proposed settlements underscore a blatant attempt by their counsel to secure a financial windfall without providing substantial benefits to class members. This approach, devoid of merit and grounded in economic misrepresentations, only enriches the Plaintiffs’ counsel at the expense of consumers of the real estate industry’s integrity.